Integrated Third-Party Administrator Can Improve Health Plan Value

Self-insured health care plans have grown in popularity in response to changes in the market

Self-insured health care plans have grown in popularity, especially since the nationwide health care overhaul 10 years ago. More employers, including those with less than 1,000 employees, are agreeing to take on the risk of assuming expenses themselves in order to reduce overall health care and benefit costs. However, if employers are not versed in the administrative side of providing health care benefits, all the advantages of a self-insured plan could be lost in mismanagement.

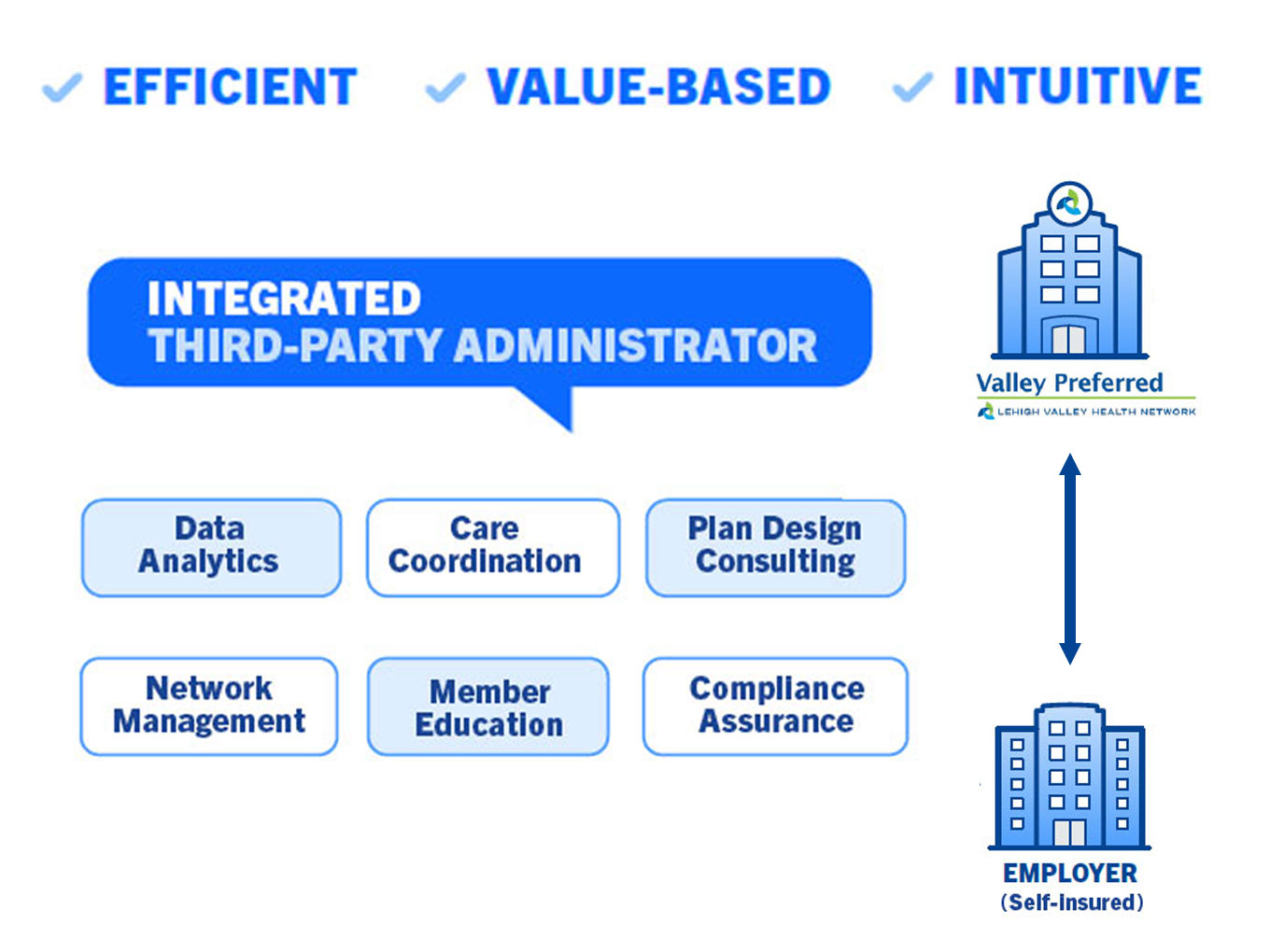

As employers, large and small, seek out health care alternatives for their employees, some are opting for direct contracting arrangements, where they contract directly with a provider, such as a hospital system or health network. If this provider is well-rounded and involved in population health management, claims administration, care coordination, and data analytics, the employer has the advantage of an “integrated TPA (ITPA).”

How is an ITPA different?

In general, a third-party administrator (TPA) helps with the design, launch, and ongoing management of a health plan. With insurers’ traditional plans, the TPA is built in, usually a department inside the insurance company. However, self-insured employers need to find a TPA on their own. Employers that choose a direct contracting arrangement can give themselves and their plans an edge by choosing a provider or provider network that integrates a multitude of innovative capabilities into its TPA services.

“An integrated TPA is able to provide all the standard services needed with a self-insured plan but offers other capabilities that serve to optimize the performance of the health plan,” says Robert Knauss, Administrator of Business Development, Sales and Marketing at Populytics. “One vital aspect is data analytics, which allow us to zero in on ways to cut inefficiencies, identify and intervene with high-risk health conditions, and gather the right information to help control the medical costs and medication habits of employees.”

He adds, “Having advanced technological capabilities also means being able to keep up with increasing amounts of data, manual workflows, and industry regulations in the self-funded insurance realm.”

The addition of care coordination

Another aspect unique to an integrated TPA is care coordination, something that only an organization able to collaborate with both health care providers and data analysts can offer. At its core, care coordination enables information sharing among all the providers involved with an employee’s care. Each member of the care coordination team works to identify their needs and preferences and communicate them at the right time to the right people, so that information is used to provide safe, appropriate, and effective care to the patient.

Actionable information about the employee population under management drives care coordination interventions. In addition to sharing EMR information, care coordination teams rely on claims data to develop registries that proactively identify patients most in need of care coordination services. Using integrated claims and clinical data provides a more complete picture and shows what is, and isn’t, happening with that employee. That helps direct valuable resources for the greatest impact.

By closing gaps in employees’ care and following up after health care events, care coordination has been shown to be effective at impacting costs associated with readmissions. According to a study in Population Health Management, “Patients receiving waiver-funded care coordination had a 19% lower probability of hospitalization after receiving care coordination relative to patients who received usual care, for a mean savings of approximately $1500 per year per patient.”

Providing more value

With costs on the upswing and health issues mounting as a result of COVID-19 surges and their resulting problems, employers are eager to find health plan alternatives. A direct contracting arrangement coupled with the expertise of an experienced provider and integrated TPA can make a difference as you endeavor to offer the best possible assurance for your employees.

An ITPA provides:

- Plan design and drafting: Employers may work with ITPAs to choose and design the benefits they offer to their employees. The ITPAs may also draft the plan/policy document.

- Enrollment: ITPAs usually enroll employees and manage their eligibility for the health plans. They may also educate employees on the benefits available to them.

- Claims processing: This involves scrutinizing and paying out employee claims. ITPAs also sometimes provide hospital bill auditing and subrogation services.

- Compliance: ITPAs ensure that the self-funded health plans are designed and operated in accordance with the Employee Retirement Income Security Act of 1974 (ERISA), the Health Insurance Portability and Accountability Act (HIPAA), the Americans with Disabilities Act (ADA) and other federal acts that self-funded health plans are subject to.

- Provider network management: ITPAs choose provider networks for employers, or in the case of direct contracting, have a provider network at hand.

- Data reporting: ITPAs furnish employers with detailed information and data on claims and costs.

- Wellness program development

- ID card issuance

Gain control over employee health care by going directly to the source